The CO2 tax makes fuel more expensive

It is an image that we should enjoy and exploit: falling petrol and diesel prices at petrol stations. In mid-November, fuel costs at the pumps fell noticeably, diesel by an average of 5 cents, gasoline E10 by 2.5 cents, compared to the previous month. According to the ADAC, a litre of diesel recently cost 1.749 euros on average throughout Germany. The liter of E10 was 1.767 euros. And we can expect prices to fall further. According to a forecast by the ADAC, there is still the possibility of diesel in particular, also because diesel is taxed at around 20 cents less than gasoline. The price of crude oil, which has been moderate for several weeks, is the cause of this pleasing price development. The oil refining industry passes on the low price to the pumps.

Since January 2021, German consumers have also been paying for their emissions at the gas station via the CO2 price. Since then, the carbon dioxide levy has been levied on natural gas, heating oil, gasoline and diesel - it started with an increase of around 7 cents for a liter of gasoline and about 8 cents for a liter of diesel. Since then, the tax has provided an annual surcharge on fuel costs.

Projected price development in the coming years

| Year | Price CO2/ton | Price increase/litre of petrol* | Price increase/litre of diesel* |

|---|---|---|---|

| 2021 | 25 Euro | approx. 7 cents | approx. 8 cents |

| 2022 | 30 Euro | approx. 8.4 cents | approx. 9.5 cents |

| 2023 | 30 Euro | approx. 8.4 cents | approx. 9.5 cents |

| 2024 | 45 Euro | approx. 12.7 cents | approx. 14.2 cents |

| 2025 | 55 Euro | approx. 15.7 cents | approx. 17.3 cents |

| 2026 | 55 to 65 euros | approx. 16.9 cents | approx. 18.9 cents |

* Price increase in relation to the year 2023

Source: ADAC

At the time when the tax was introduced in 2021, 25 euros per ton of carbon dioxide had to be paid. In 2023, the increase was interrupted due to the general sharp rise in the cost of living, which was actually supposed to rise continuously. It will not continue until 2024 and the ton costs 45 euros, and by 2026 the price is expected to be between 55 and 65 euros.

With the income generated in this way, the state promotes energy-efficient housing renovations, the conversion of heating systems to renewable energies and cars with alternative drive systems through the Climate and Transformation Fund. These include, for example, e-cars, about which a lot of information can be found on the topic page on electromobility. The expansion of the charging infrastructure will also be subsidised from this fund.

Broken down to the liter of gasoline and the liter of diesel, prices at the pumps will rise by 3 to 4 cents in 2024 due to the CO2 tax alone (uniform gasoline and diesel) and the increase in price will continue in the next few years.

When driving a car with an electric drive or when driving hydrogen cars, no CO2 tax is due.

Can I avoid the price increase if I fill up with biofuels?

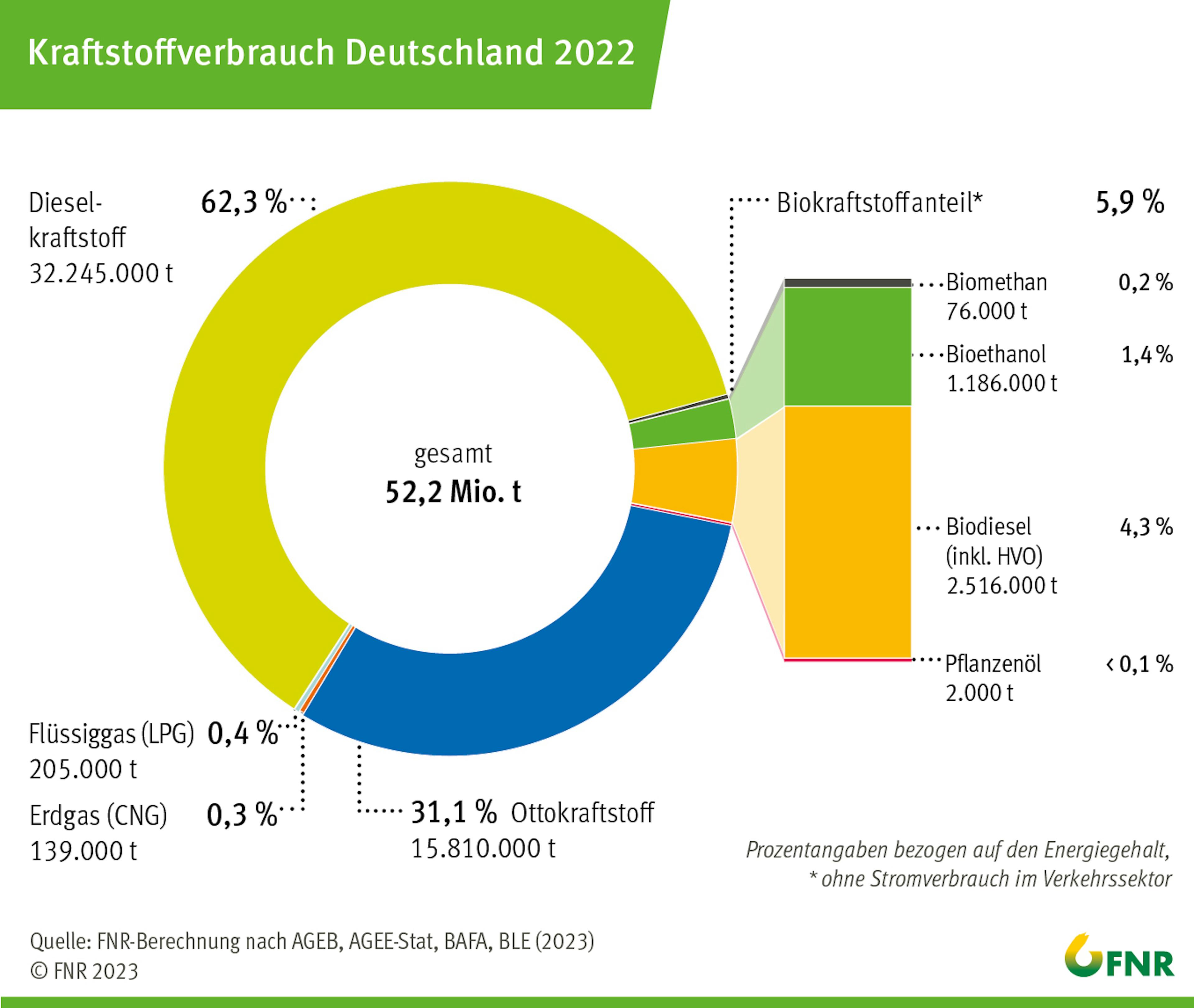

It depends. Only sustainable biogas is not subject to a CO2 price. However, its share of the German fuel mix is vanishingly small (see chart). On the other hand, the tax is levied on biodiesel or HVO, which together accounted for a good 4 percent of German fuel consumption in 2022. "HVO from residues and waste materials is subject to the CO2 tax on a pro rata basis," explains Benedikt Zimmermann, Chairman of eFuelsNow e.V., an association that campaigns for the fastest possible release and introduction of renewable fuels as a supplement to electromobility. "HVO100 is 90 percent climate-neutral, which is why only 10 percent of the tax is levied on it."

With a lower proportion of blends with fossil diesel, the tax surcharge is to grow in percentage terms, as of today. Legislators are still discussing the exact classification of HVO, but it looks as if the price will rise less sharply than that of purely fossil diesel.

The abbreviation HVO stands for "Hydrotreated Vegetable Oil", to German: "hydrogenated vegetable oil". In addition to vegetable oils, waste or oils and fats from residues, such as used cooking oil, are used in production for this type of diesel. Like biodiesel, pure HVO burns without releasing fossil carbon dioxide at the exhaust. However, HVO production is not fundamentally climate-neutral, as the German electricity mix still contains too large a proportion of fossil fuels. Therefore, the more green electricity is used in generation, the better the GHG reduction potential of HVO becomes.

Since the fuel properties can be influenced in a targeted manner and as required during the production of HVO, there is no need to adapt the engine to climate-friendly fuel. The fuel can be refuelled and moved in any mixture or as pure fuel.

In other European countries, the advantages were recognized years ago. In the Benelux countries, Scandinavia, Italy and Austria, the network of filling stations is already well developed with an HVO service. Germany is only slowly starting to follow suit, as the sale of pure HVO to private customers will only be permitted after a cabinet decision of 22 November 2023. Previously, only diesel fuels with an admixture of HVO were approved for sale.

For us consumers, the approval is a win-win situation: With every HVO100 refueling, we can ensure that less fossil fuel is burned, and we can almost completely avoid the annoying fuel price increase due to the GHG quota.